Help to Buy: what is it exactly?

You finally found the home of your dreams, but how you can afford to purchase it? Here is where the Government backed Help To Buy scheme may offer you a borrowing solution and help you to get onto the property ladder.

What is Help to Buy?

As the name suggests, the Help to Buy scheme was implemented in 2013 to help buyers who cannot afford to put down a large deposit. Since then, it has helped hundreds of thousands of people to realise their dream of owning their own home.

In a few words, the scheme allows you to purchase a property with only a 5% deposit, and the Government will lend you up to 20% of the property value (40% in London). For the remaining 75%, you will need to take a standard mortgage.

How much interest do you pay?

The equity loan is free of interest for the 5 first years then, in the sixth year, you’ll be charged interest at a rate of 1.75%. It increases every year in April, by adding the Consumer Price Index (CPI) plus 2%.

What are the eligibility criteria?

You must be a first-time buyer

With Help to Buy a repayment mortgage must be taken out

You have to buy a new build property which is part of the scheme

Help to Buy cannot be used for second homes

You can’t use it to buy a property to rent out

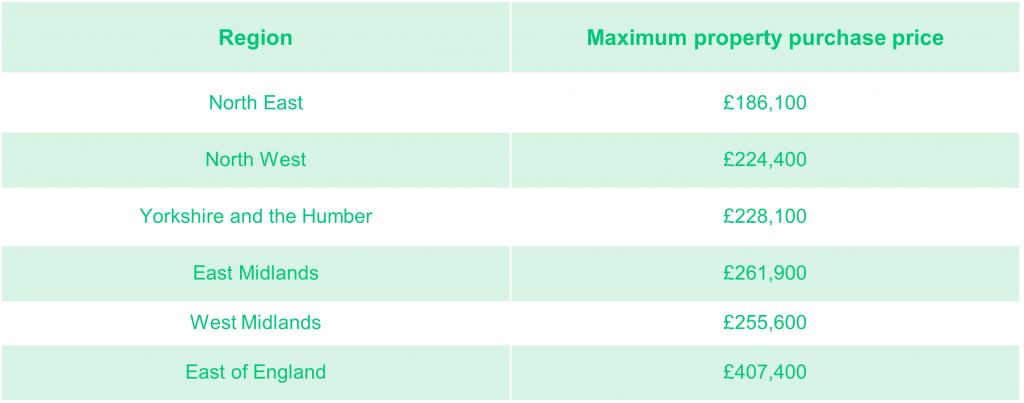

Help to Buy regional price caps

Help to Buy regional price caps

When does Help to Buy end?

Unfortunately, the scheme is coming to an end. The last date you can apply for the Help to Buy is 31 October 2022 – this should allow enough time to legally buy your home before the scheme ends on 31 March 2023.

Have a look here if you want to apply for an equity loan in the Midlands and London:

Our latest East London development Stratford Park is Help to Buy accredited – find out more here.

We hope you found this article useful.